Here we are after a very interesting quarter.

At the end of February, I was chatting with an investor friend and he mentioned the Coronavirus situation in China and how it is already starting to spread in Italy. For all practical purposes, the West was treating the virus as a non threat. “The Chinese are not able to deal with it, but we with our great health care infrastructure will be able to handle it!”. The friend was of the opinion that we should protect our portfolios by buying puts on the market.

“Shouldn’t we spend 5% of our portfolio on protecting our ~30% gains from last year?”

This was a good way to approach the situation. I acted, but unfortunately, in a very half assed way. I only put 0.5% of my portfolio in protecting myself. Even that was really hard for me to do because I have labeled myself as a long term investor and had promised to not get into options. I am happy that I was willing to change my mind. But, I am rubbing my nose in the mistake I made by not putting a more reasonable portion. I think putting 2% would have been a good strategy.

Learning: Do not put labels on yourself. Your goal is to maximize your wealth in the safest way possible. It is not to subscribe to a certain way of thinking.

COVID Strategy

Fortunately, all the stocks I had were Corona proof. My whole portfolio consisted of only 5 companies: GOOG, FB, HIK.L, IBKR & BRK.B. I bought puts on S&P, sold BRK.B and decided to let this blow over.

The speed of the drop was incredible. The S&P 500 dropped ~ 34% between Feb 20 and March 23. And then did a V-shaped recovery. My portfolio fell 25% — but I handled it quite well. I started a 1% position in MSFT, and added to FB, IBKR & GOOG. I also used the opportunity to lighten Hikma pharma (sold 40% of the position) at 1835 & 2052 Gbp.

Square

During this time, I finally decided to look into Square & Shopify. Square was the one which was punished much more and it made sense to look into it. Square has some really interesting products. Their payroll solution seems to be the second most used in the US, just after Quickbooks. They also went into personal finance via Cash app, which is looking at fantastic growth while their merchant solutions segment is only seeing a GMV growth of ~ 20%.

“US payments volume via cards was $7t in 2018 with a growth rate of ~ 8%. Furthermore, 25% of transactions are still done via cash in the US. Thus, with a current payments size of $10t in the US, Square is currently at 1%.

Square is already making progress internationally. One of the main reasons for Jack Dorsey’s move to Africa was the cash rich economy and the growth in payments.”

Square vs Shopify

Comparing it to Shopify, it seems Square and Shopify are targeting similar merchants. Shopify is transitioning from online -> brick & mortar, while Square is going the other way. Furthermore, Square’s strategy of moving into personal finance via Cash App is not something that fits Shopify’s strategy.

In terms of pricing, there are also differences. Square can be tried for free and add-ons can be added for additional charge. Shopify, on the other hand, seems to have a price tier based on GMV.

“On the other end, Square’s economic moat is challenged by Shopify’s entry into physical retail with it’s retail kit that eerily mimics Square’s aesthetic. Time will tell if Shopify can gain adoption and gain market share away from Square. But one thing is for certain, Shopify will be able to leverage its existing 500K active businesses using its product as a qualified customer list. “

— link

Back to Square

Unfortunately, Square has a 10% dilution due to stock based compensation. This was something I was not able to handicap. I am also not sure about the moat of a personal finance app. EU itself has Revolut and Transferwise and I think people generally have both accounts. The Cash App also seems to be targeted at people with low financial education — which is probably quite a large market worldwide. You can buy bitcoins and fractional shares.

All in all, I decided to take a pass. The combination of competition from Shopify/Wix, huge dilution and low moats of personal finance apps leads me to a proposition which is too hard for me to evaluate.

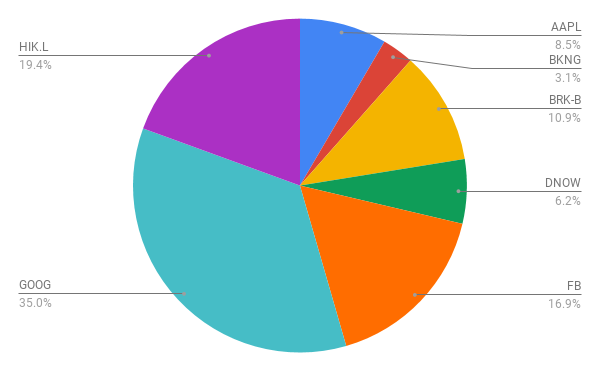

Performance

At the end of June, I am up 3.5% since the beginning of the year, with 24% of my portfolio in cash. The cash is included in the performance number. Meanwhile, S&P500 (without dividend) had lost 4.8%.

Comment on cash

Even at the worst of the crisis, I could not find good ideas where I can go in — except maybe Microsoft. At $137, I found it still too expensive. The cash is, hence, a byproduct of not having ideas. Worse, I thought that COVID would finally lead me to a portfolio without cash but it did not come to pass. I started with ~20% of the portfolio in cash and finished with 24%!

Probably, 24% is too much. I will look into ways of reducing it to 10% of my portfolio.

New rule: Keep your cash position under 10% of your portfolio.

New rule: when you start a new position, the first buy has to be 2.5% of your portfolio.